Buyer, Do You Know What You are Buying?

When buying a house, vacant lot, or commercial property the buyer must take responsibility to do his or her own research. Don't take the attitude the real estate agent, appraiser, or title company is paid to do that for me. Learn from the commercial and industrial investors that make their living purchasing properties. They hire professionals to assist them in their decisions, but they also do their own research.

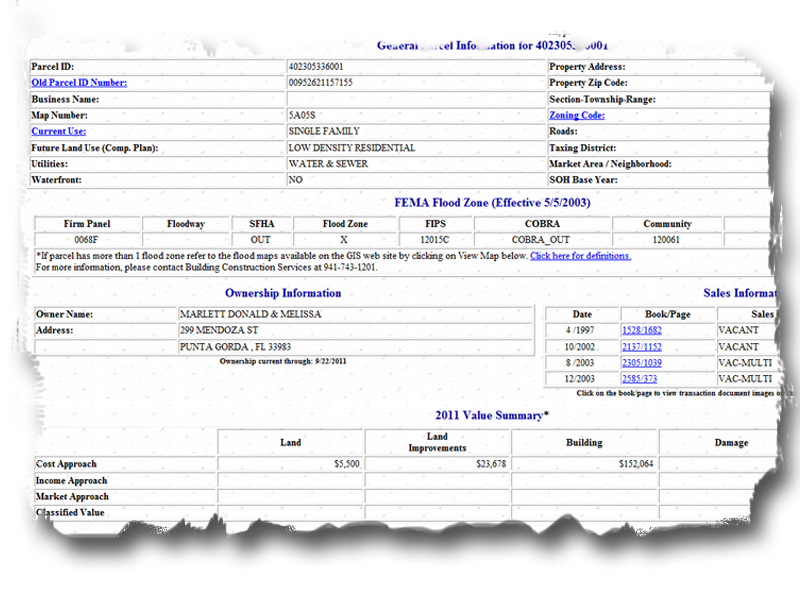

I'll take you through a few simple steps that will give you a great deal of information about a property. Start with the property appraiser's website, Charlotte County Property Appraiser. This website will be your best friend when you research a Charlotte County property. The site is user friendly. Insert the address you wish to research to view the size of the structure, year built, assessed value, and current owner's name. There is a link to view map. The view map link will take you to the GIS website and you can see the aerial with the property highlighted in yellow. By using the tools along the left side of the screen, you can move around the neighborhood for a good overall view of the area. The tools on the right side of the screen give you layers to discover things such as the nearest water hydrant, zoning, future land use designation, etc. Why would I be interested in looking around the neighborhood? If the property in question is surrounded by vacant land, I'd like to know what that land is zoned. The zoning will give you a clue as to what may be built near or next to you. The wise investor will want to know this key element to determine the potential for future value growth or lack thereof.

The water hydrant gives you a clue as to the proximity or existence of public water in the area. This information is useful to the insurance company as well. I would suggest you call the public utility company in the area to insure public water is to your site and connected. I appraised a house where public water was on the street and the property owner insisted public water was connected to the house. I questioned this because a meter could not be found. The property owner insisted he paid for public water. Upon verification with the utility company, it was discovered there was no connection to this structure. Again, buyers do your research.

The tax record will also give you a clue that an addition was added without a permit. If the square footage shown on the public record is much different from the size reported by other sources, go to the tax appraiser's office to request a copy of the sketch. Question the seller about the permit status of the addition. Is the addition properly permitted and up to code? What would that matter?

It could stop the closing and/or create a surprise down the road. For example, you purchased the house and later the tax appraiser discovered the addition and no permit. You could be liable for back taxes and obtaining a property permit that may require you to bring the addition to code and pay penalties. Does this always happen? No, but it is a potential problem that should be considered. If you are willing to pay the consequences and know the risks, you are ahead of the game. It is also possible that this would not be discovered until you sell the property. This could stop or hold up a closing for weeks.

Look at the taxes and assessed value. The tax record will give the exemptions the property owner is currently paying. You may not have the same exemptions and the tax-appraised value could be raised to market value after the sale. (There really are properties in this county that are not appraised at market value.) If the property is owner occupied and has a homestead exemption subject to the save our homes ruling, the taxes may be much less than you m ay experience once you acquire the property. This ruling may change with the next election. No matter what happens with the tax law, the tax issue is one that should be of major concern. Think about the consequences when you receive notice from the mortgage company that the escrow account is under funded due to the tax increase that was not considered on purchase and your payment just went up 30% to cover the costs. Can you afford such a surprise?

ay experience once you acquire the property. This ruling may change with the next election. No matter what happens with the tax law, the tax issue is one that should be of major concern. Think about the consequences when you receive notice from the mortgage company that the escrow account is under funded due to the tax increase that was not considered on purchase and your payment just went up 30% to cover the costs. Can you afford such a surprise?

The tax record provides a legal description and there is a link to the recorded deed. By clicking on the document number, you can view a copy of the recorded deed and a more detailed legal. The sales history of the property is also displayed on the tax record and maybe of interest to you. The actual purchase price should be recorded on the tax record. Buying a house is one of the largest investments most of us ever make. Be a wise investor, hire professionals to assist in the purchase and do your own research.

If you have a real estate appraisal question email me at adomatis@hotmail.com.

Written by Sandra Adomatis for the Sun-Herald Newspaper, Market Place Section